Download the European Luxury Report 2024, following on from our Global Luxury Report 2024, this report takes a deeper dive into consumer behaviour and attitudes in this region. The report analyses the growth of European luxury retail and ecommerce that has plateaued, this however isn’t necessarily a sign of the market stalling, but more an indication it is evolving. The report uses the results of our ConsumerX data to analyse attitudes to what, why, where and how Europeans’ buy luxury goods.

Inside the European Luxury Report

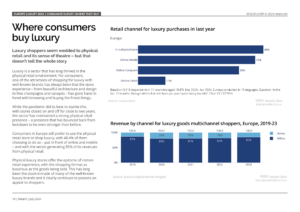

Following steady growth across much of the 2010s, European luxury online sales have flattened out since the pandemic, with the sector recording virtually no growth from its €15.5bn level in 2021. Indeed, 2023 brought a small downturn to €15.4bn, as against €15.52bn in 2022.

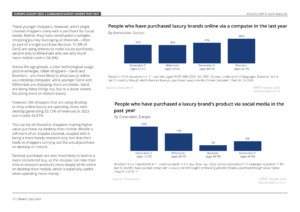

But the sector is still buoyant, with more consumers choosing to buy luxury than ever before. For 92% of consumers, it is quality that drives them to buy, far ahead of other factors, including brand reputation (63.2%) and fashionableness (42.3%).

European luxury retail sales are dominated by fashion, which generates €5.9bn, more than a third of the sector’s total revenue in 2023. Luxury cosmetics accounted for €4.1bn. This is backed up by RetailX’s ConsumerX consumer data, which shows that luxury fashion and apparel was the segment most likely to generate multiple purchases among 43% of shoppers.

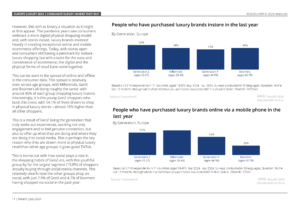

The largest single group buying luxury fashion are GenZ-ers, with 56% in this cohort saying they have made multiple luxury fashion purchases in the past year.

EU luxury ecommerce is tempered by shoppers being wedded to the theatre and experience of physical retail. On average, 48.4% of European consumers prefer in store, yet these generate 85% of revenues. This is way more than the 30% who shop online. Interestingly, it is the young GenZ shoppers who buck this trend, with 54.1% of them drawn to shop in physical luxury stores – almost 10% higher than all other shoppers.

Consumer research shows that 79.5% of all European luxury shoppers are interested in buying sustainably. While consumer data shows that 31.5% of European shoppers say that they wouldn’t pay more for sustainable luxury, the remaining 68.5% – more than two thirds – say they would.

The flattening out of European luxury revenues seen in 2023 is set to continue, however. Data shows that 57.3% are expecting to spend the same amount in 2024, while 27.5% will be lowering their luxury spending.

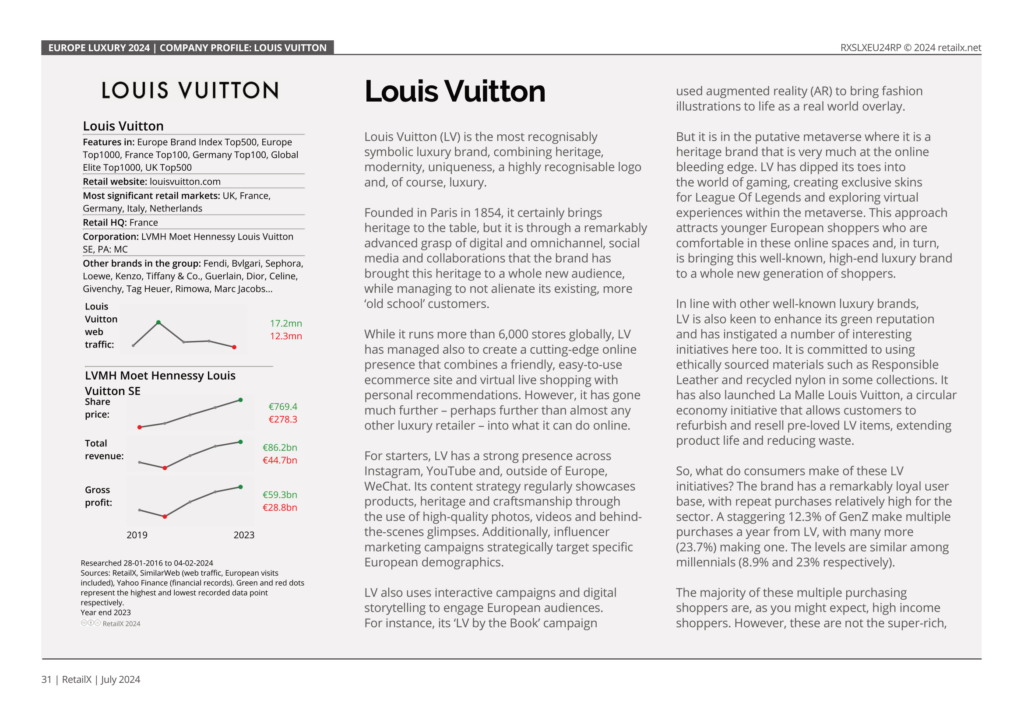

Luxury Company Profiles

Our analysis of the European luxury market is illustrated with company profiles showcasing the nine retailers standing out in the market. Each profile offers company profit and sales figures, share price and web traffic as well as a review of what makes their business exemplary.