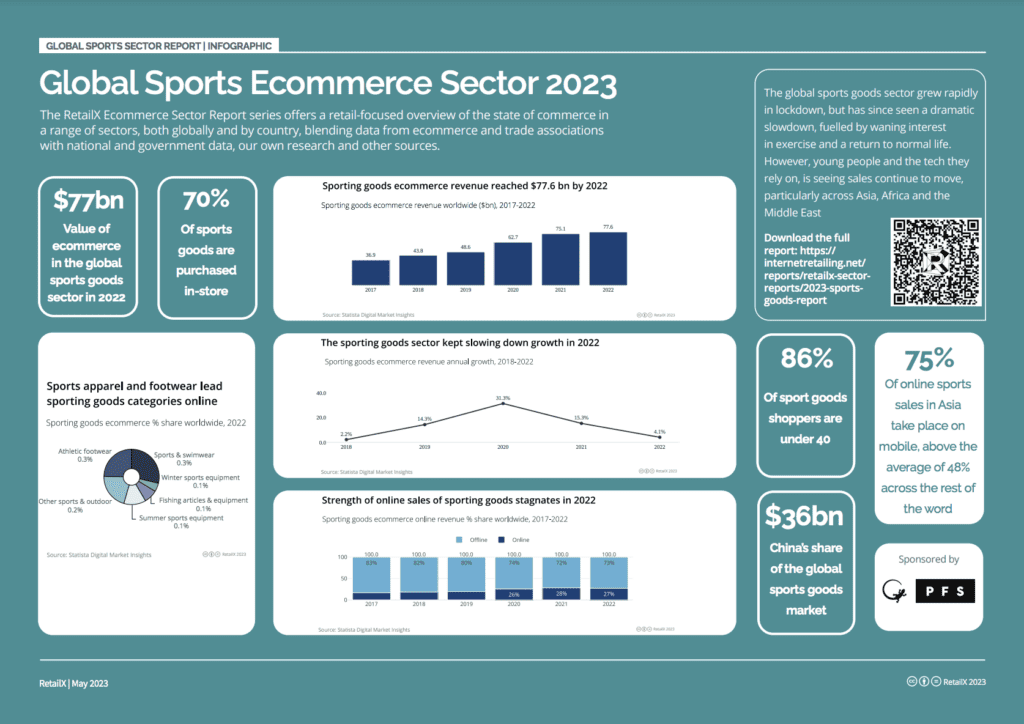

The global sports sector is a $77bn industry, attracting users at all levels of sporting prowess. The pandemic boosted its fortunes as, with everything shut, people took to sports and exercise to fill their days. Now, with the world going back to normal, sales are slowing – but the sector still has much to give.

Sports goods has kept afloat largely by fashion and athleisurewear. The rise of ‘athleisurewear’ during the pandemic has been one of the most marked changes to reshape both the sports and fashion sectors in recent years. A combination of sportswear and leisurewear, athleisurewear was already a key trend pre-pandemic but the blurring of the work-home life balance has seen its sales increase during 2020 and 2021.

This extensive report lists who the largest 50 global sports brands and retailers are plus their performance. While the global sports goods market is dominated by enormous, well-known brands, a wealth of localised players also attracts a lot of traffic.

We also explore the increased use of tech to gamify and add other dimensions to sport and fitness, attracting in new, younger users looking for a more playful, social and immersive experience. The continued and growing role of sportswear in fashion will also be a continuing boon for the sector, which is one that is assured of growth even in these challenging times.

The sports goods sector is in rude health, driven by rising interest in fitness. However, it is facing a range of challenges around balancing often expensive sale price of precision goods against a growing cost-of-living crisis worldwide.

Download the full report for insight into:

- Who are the largest 50 global sports brands and how do they perform?

- How Athleisurewear and fashion sports have saved this sector

- How Asia is leading the way in sports goods sector growth after a post-pandemic slowdown

- How sports sales are dominated by Gen Z

- Sports goods consumers want to be sustainable but they also like high turnover and brand new items

- How consumers shop: online versus instore

- What next for this sector as consumers become more tech-orientated?

Report highlights:

- 57 pages of market-leading research into the global sports goods sector

- 56 illustrative RetailX figures, charts and graphs

- Exclusive company case studies: Adidas, Decathlon and SportsShoes.com,

- 11 company profiles including: Asics, Camping World, Garmin, Gymshark, MyProtein and The North Face

Remember to download the accompanying datagraphic